in brief

A flexible, scalable, efficient fixed-income accounting solution to support financial institutions that have portfolios of instruments of varying complexity

Paragon is a fixed income solution with a strong track-record over two decades serving a diverse range of financial services organizations: from small community or regional banks, credit unions, fixed income broker-dealers, correspondent banks (that provide third-party administration services to banking clients), to several of the top-tier banks in the US.

Paragon provides a broad selection of amortization and accretion calculations, that can be assigned by different types of customer and security. The software supports retrospective and prospective accounting for MBS, ABS and CMO securities.

Extensive asset class coverage – Paragon handles a full range of complex fixed and variable rate instruments with ease, including the following asset classes:

- Mortgage-backed securities

- Asset-backed securities

- Debentures

- Treasury securities

- Other fixed-income instruments

- Money market instruments

Automate processing – Paragon is a front-to-back-office accounting and processing solution supporting compliance requirements, transaction processing workflows and flexible reporting. Benefit from automated, unattended processes that enable the management of your fixed income trade positions efficiently, eliminating month-end reporting bottlenecks through associated with manual steps and processes.

Manage the things that matter – Comprehensive, easy-to-use exception management tools execute unattended processes able to manage high volumes of complex instruments.

Save effort, time, and money – focus on what is important and automate where it adds value.

common challenges and solutions

Creating a single book of record

Multiple systems used to perform accounting and reporting.

Automation of key processes

Operations teams are constantly having to gather and reconcile data from multiple systems.

Effective use of collateral

Inconsistent evaluation of collateral requirements and usage.

what Paragon does

Paragon is a fixed income portfolio accounting solution, processing bonds and money market instruments based on three primary business functions: trade capture, processing and reporting

Accounting and position-keeping platforms help banks manage their exposures on a day-to-day basis. When it comes to reporting concise information to executive board members and stakeholders, however, old style paper reports are generally not only dull in presentation style but often lack graphics to provide clarity and reflect notable changes or exceptions.

Paragon offers inventory, cash flow, maturity and management reports that are enriched with visually appealing graphics. This will provide greater insight to all stakeholders and inform decision makers based on data extracted directly from Paragon’s records. This step will avoid the potential errors that can occur if information needs to be manipulated or augmented before being delivered to interested parties.

Paragon has a proud track record of serving a diverse range of financial services organisations – from small community or regional banks to several of the leading US banks. The solution also supports credit unions, fixed income broker-dealers and correspondent banks that provide third party administration services to banking clients.

Paragon is proven over many years to be excellent at handling the full range of complex variable rate instruments with ease:

- Mortgage backed securities

- Asset-backed securities

- Debentures

- Treasury securities

- Other fixed-income instruments

- Money market instruments

Paragon provides comprehensive, exceptions only, unattended processing – able to manage high volumes and complex instruments. This front-to-back office accounting and processing solution addresses complex compliance requirements, transaction processing workflows and flexible reporting.

Paragon ties together the front, middle and back office with dashboards that give a real-time view of the firm’s activity. Users have total control, with integrated tool kits to make adjustments to exceptions as they arise.

Clients benefit from automated processes that get the job done right, every time. This expedites the close of each accounting period, knowing all accounts are reconciled. Our advocates are controllers, treasurers, wealth managers and CFOs, all benefiting from our reporting, audit and regulatory expertise.

Trade capture

Capture trades as they are executed from any source. Paragon automates the import of trades directly from multiple OMS platforms or via a manual trade capture screen.

Processing

Paragon’s accounting engine handles a variety of investments utilizing automated processing to create unattended workflows designed around exceptions-based processing.

Reporting

With more than 180 preconfigured reports, Paragon enables users to customize standard report outputs to comply with your business requirements and meet the needs of different divisions within the bank.

Paragon modules

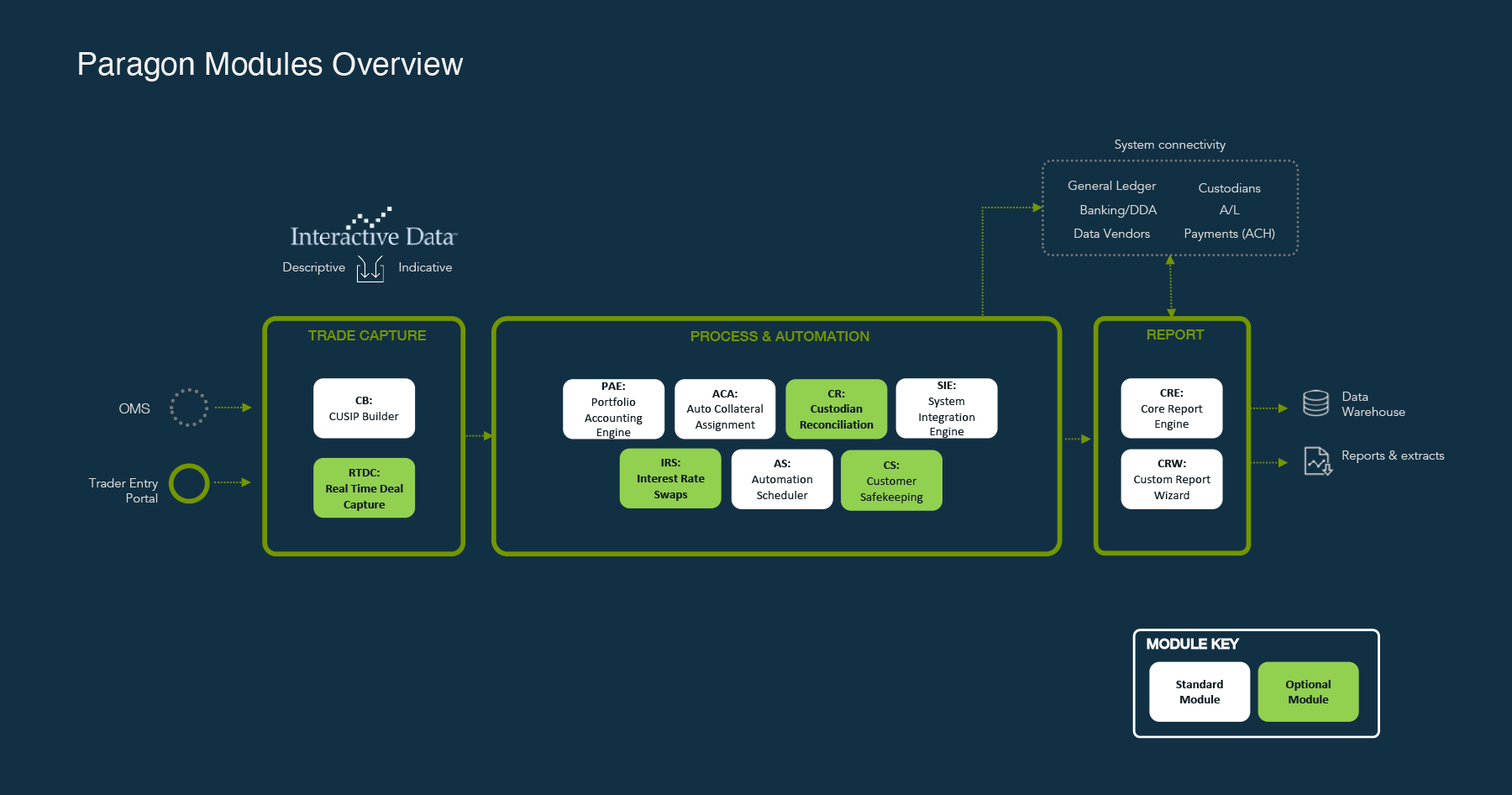

Paragon modules and connectivity

Paragon is a modular, end-to-end, robust fixed income portfolio accounting solution that processes bonds and money market instruments based on three primary business functions: trade capture, processing, and reporting. Paragon has standard modules to support core business requirements with optional modules to assist banks with specialized processes. This diagram summarizes the flow of trade records through the system and modules.

MODULES:

CB: CUSIP BUILDER (Security master feed)

RTDC: REAL-TIME DEAL CAPTURE (Interface to OMS platforms)

PAE: PORTFOLIO ACCOUNT ENGINE (Core Paragon component)

ACA: AUTOMATED COLLATERAL ASSIGNMENT (Algorithmic management of collateral)

CR: CUSTODIAN RECONCILIATION (Holdings & cash matching)

SIE: SYSTEM INTEGRATION ENGINE (Toolset for data flows)

IRS: INTEREST RATE SWAPS MODULE (Interest rate derivatives)

AS: AUTOMATION SCHEDULER (Process unattended workflows)

CS: CUSTOMER SAFEKEEPING (Manage holdings for bank customers)

CRE: CORE REPORT ENGINE (Catalog of standard reports & extracts)

CRW: CUSTOMER REPORT WIZARD (Self-service report & extract creation)

Asset types (acquired & issued)

Paragon supports a substantial list of sub-asset types associated with the asset classes listed below:

- Asset-backed securities

- Mortgage-backed securities

- Collateralized mortgage obligations

- Treasury bills/notes/bonds

- Government agency notes

- Municipal bonds

- Corporate bonds

- Whole loan packages

- Private placement debt

Money markets

Overview of US money market instruments supported in Paragon:

- Fed funds bought/sold

- Repo/Reverse Repo agreements

- Brokered CDs

- Federal Home Loan Bank advances

- Intercompany loans

- Commercial Paper

Paragon highlights

Reduce risk, costs, and inefficiencies

Introduce effective process automation and reduce risks and costs. Connect business processes to remove manual intervention, introduce effective operational practices allowing users to focus on what is most important.

Processing automation

Benefit from comprehensive, exceptions only, unattended processing – managing high volumes and complex instruments with ease. Our automated processes expedite the close of accounting periods, knowing all accounts are reconciled. Paragon automatically updates prices, factors and call information and has the ability to import prices via Excel. The software also tailors tax equivalent and after-tax yield calculations for any state and TEFRA implication.

Regulatory reporting

Regulatory extracts and reporting – high flexibility reporting features and reporting content choices to respond quickly to regulatory reporting requirements, and market changes. Create your own reports to meet specific reporting needs.

Extensive interfaces

Connect to your OMS of choice for trade delivery, as well as a data provider to support accounting data requirements such as pricing and factors information. Deliver data output to downstream systems such as general ledger platforms that complete processing chains.

key benefits

Save time and money

Mitigate costs and operational risk that comes with manual processes. Save time with our exception management-based solution provides automation for trade capture, position processing, accounting, and reporting for fixed income investments and wholesale money market transactions. For example, Paragon supports automatic paydown processing, including factored calls and payups.

Compliance

Be confident in meeting processing and regulatory obligations along with client specific needs – demonstrating compliance with processes and audit trails assessed by governance divisions and regulators.

The fixed income accounting industry is often challenged with different methodologies. The Paragon team of experts is here to help guide and provide best practice advice.

Flexibility

Not all banks are the same. Paragon provides client-specific configuration to meet pre-established business processes, offering optional modules only if they are needed to suit your business model. End-to-end accounting processes address complex requirement associated with how you run your operations.

Scalability

Meet your deadlines and enable your business to grow. From small local banks to tier one institutions, we have the processing power to support extensive portfolio processing and calculation performance no matter how high the volumes.

Bank mergers and acquisitions are a regular occurrence and combining position records onto a single platform can be daunting. Accelerate merger processes, without concerns regarding position volumes or payload, because Paragon handles processing and calculation volumes without missing a beat. Our M&A tools help manage the merging of positions across multiple institutions in a cost-effective, and timely way. Paragon can also track numerous alternative book values for M&A or tax purposes.

how it works

A standard model for all

The days of lengthy projects with long drawn-out product and user configuration for your business and IT teams – even before you get to detailed UAT activities – must be put behind us.

Paragon is a working product not a toolkit; built on a standard model principle, with all modules available to our entire client base, simply controlled by licence agreements. This enables fast implementation times and predictable implementation costs.

Paragon can be installed on physical servers on a local client network or deployed on virtual machines provided on private cloud facilities from third-party service providers.

Paragon also provides an easy upgrade path and highly experienced support staff. New versions with additional functionality are available regularly for all licensed customers. Deployment to UAT takes days rather than the weeks and months that are often required of other applications.

Deployment options

We recognize that our clients need choices when considering system deployment. Choices that meet our clients’ operational demands, delivery approach and IT strategies. corfinancial offers the flexibility clients expect.

A.

Install Paragon locally on their internal servers within existing network infrastructure.

B.

Deploy Paragon in an existing private cloud environment.

C.

Opt for our hosted cloud services. This is a managed client installation in a client-specific environment, where we monitor, service and manage the infrastructure.

Paragon is also built to interface with a multitude of internal and external systems making for easy deployment.