Software used by tier 1 banks and asset managers to fully streamline fund administration

One system to manage all your investment administration

in brief

A fully integrated investment administration platform for third party administrators (TPAs), fund supermarkets, wealth management providers, building and friendly societies, and retail banks

Costars is a multi-asset investment administration solution that automates and improves client servicing, sale-channel uptake and the adoption of new products, including fully automated ISA management. Costars also provides management functionality for tax and regulatory requirements for underlying investors. Dealing and registration facilities are available for:

- ISAs

- Unit trusts

- Investment trusts

- OEICs

- Equities

- Cash funds and cash deposits

- Fixed rate bonds with full maturity processing

Instrument types are packaged into portfolios, whether wrapped or unwrapped and are available across varying distribution channels:

- Direct

- Open architecture platform

- IFA

- Sales network

- Nominee

- Institutional clients

Execute with confidence – handle millions of portfolios and positions with high throughput without scalability issues. With automated and manual trade input, present and historic portfolio valuations, automated customer credit and ID checks, data and documentation audit trail, full reporting and compliance, deal validation/authorisation and pricing, everything is covered.

Agility and flexibility – what you need to respond quickly to regulators, customers and the marketplace, while giving the confidence and control you want to run investment sales operations successfully.

Functionality richness – complete suite of asset, product and charge management capabilities designed to work together seamlessly – lowering operational costs and complexities of administering collective investments, equities, unit trusts and all cash instruments.

common challenges and solutions

Administering third party products has become difficult over recent years

Combatting ever-increasing operational costs

Creating a joined-up, effective workflow

solution

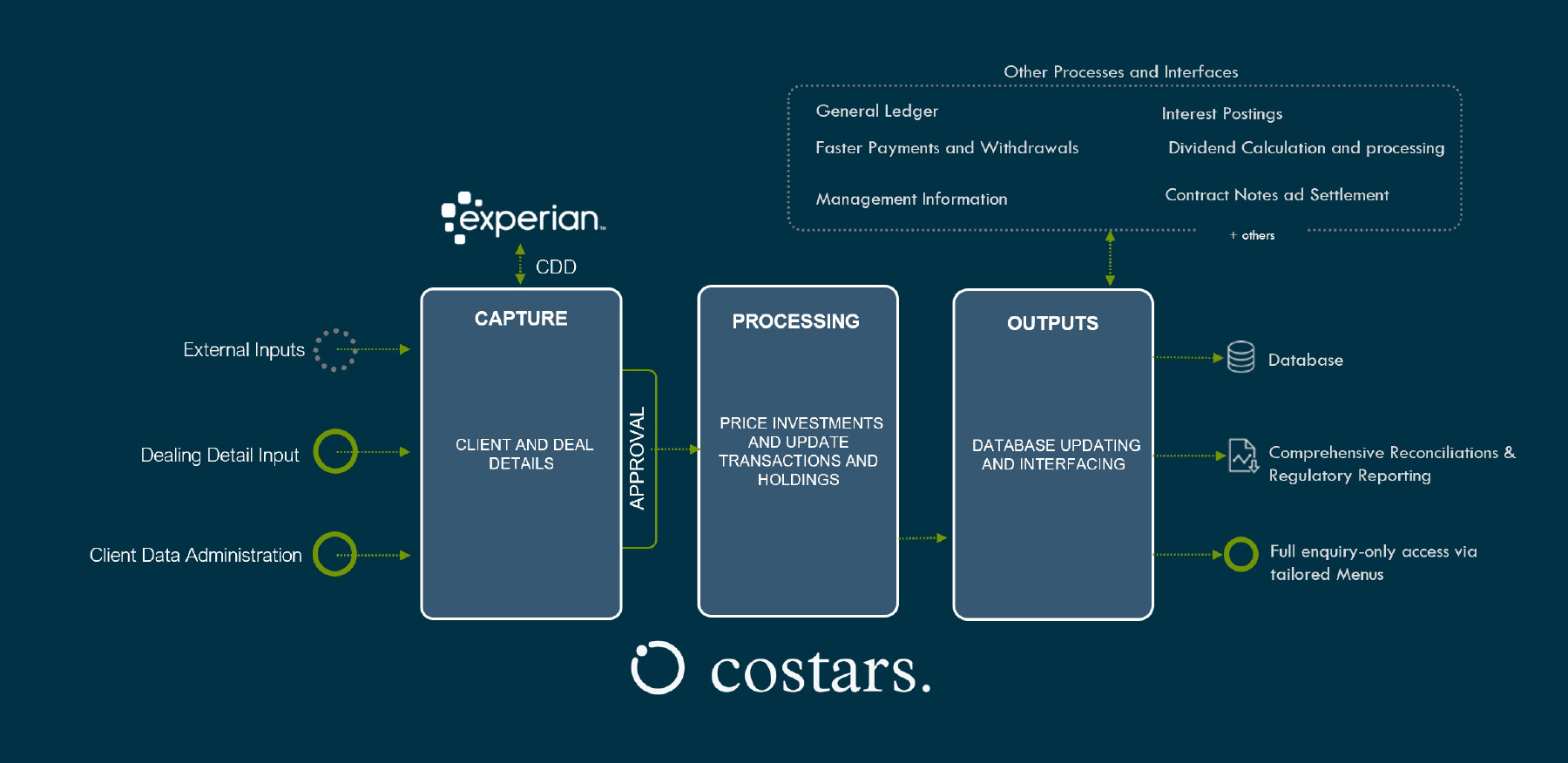

Deal capture

Deals are captured either via direct entry or API gateway, supporting fund and dealing administration as well as client servicing.

Processing

Transactions and holdings management along with administrative oversight, including pricing and valuation services, Unit trust Box management functionality, contract note production and settlement processing, KYC, and client services. Also includes fully automated dividend/distribution and interest processing for reinvestment or payment as required, as well as daily/weekly/monthly reconciliation processes to ensure the integrity of the database.

Outputs

Costars supports multiple outputs, including updates to external platforms such as general ledger and reporting solutions. There is a vast array of management information reports, as well as client information such as statements and position records.

Costars processing

Costars highlights

Reduce costs, and inefficiencies for all stakeholders

Proven workflow and automation helps you easily and effectively run successful investment sales operations.

Operate with complete confidence 100% of the time

Easy to use – easy to understand. A truly reliable, best in-class system. Enables multiple sales distribution channels and integrates into general ledger and payment processing systems, with automated dividend and distribution processing.

Extensive interfaces

Data-rich extracts – interfaces and data extracts can feed into existing internal systems such as Management Information/General Ledger. APIs can be utilised to extract client data for further processing.

Regulatory extracts

Full regulatory extracts and reporting – high flexibility to respond quickly to regulators, customers and markets. AML regulation is managed via an API to Experian.

key benefits

Automation, flexibility and control

Automation

Proven workflow and automation helps you to easily run successful investment sales operations no matter what the size of the investment portfolios to be processed.

Flexibility

Multiple channels

Control

how it works

A straight forward and simple approach

The days of lengthy projects with long drawn-out product and user configuration for your business and IT teams – even before you get to detailed UAT activities – must be put behind us. Solutions need to be quick and easy to deploy by the companies that buy them.

Costars is a working product not a toolkit; It is a fully built and functional parameter based system, with all functionality available to our entire client base thus enabling faster implementation and predictable implementation costs.

Costars can be installed on physical servers on a local client network or deployed on virtual machines provided on private cloud facilities from third-party service providers.

Move quickly and with confidence – our rapid implementation times remove the fear of those dreaded, open-ended IT projects that all too often never seem to close properly, be on time or within budget.

Export any data for reporting flexibility

Extensive interfaces

Extensive interfaces and data extracts which can feed into the client’s existing internal systems such as Management Information/General Ledger.

Data-rich

Data-rich extracts so the business has all the data at hand to utilise as they see fit.

Regulatory extracts

Full regulatory extracts and reporting.

API

API can be utilised to extract client data for further processing.